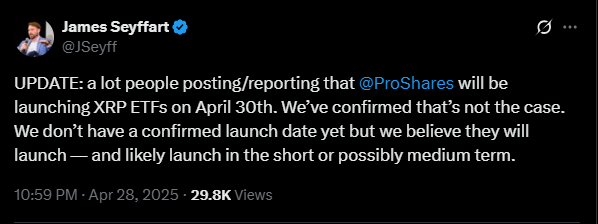

The highly anticipated launch of ProShares’ XRP futures exchange-traded funds (ETFs) has been postponed, according to a recent statement by Bloomberg ETF analyst James Seyffar. Originally scheduled for April 30, the delay comes despite the U.S. Securities and Exchange Commission (SEC) having already approved the ETFs. While no confirmed launch date has been announced, Seyffart reassured investors that trading is still expected to begin in the short to medium term. This development highlights the ongoing complexities of integrating digital assets into traditional financial markets, particularly amid regulatory uncertainty.

Understanding the Reasons Behind the Delay

The postponement underscores the intricate challenges involved in launching crypto-related ETFs. Although the SEC granted approval earlier this year, concerns about investor protection, market manipulation risks, and operational logistics remain significant hurdles. For XRP, these challenges are amplified by its prolonged legal battle with the SEC, which began in December 2020 when the regulator accused Ripple Labs of selling unregistered securities.

While Ripple has made progress in its legal defense, the lack of complete regulatory clarity continues to impact the rollout of XRP-based financial products. The delay serves as a reminder of the cautious approach regulators take when approving altcoin-based investment vehicles. These products must navigate not only the volatile nature of cryptocurrencies but also the evolving regulatory landscape.

ProShares’ XRP futures ETFs aim to provide institutional investors with a regulated means to speculate on XRP’s price movements. By eliminating the need for direct custody of digital assets, these futures-based ETFs address key concerns such as security, compliance, and operational risks, making them an appealing option for traditional investors seeking exposure to the crypto market.

Expanding the XRP ETF Ecosystem

ProShares secured SEC approval for three distinct XRP futures-based ETFs, each designed to cater to different investment strategies. The Ultra XRP ETF offers leverage, enabling investors to amplify their exposure to XRP’s price movements. Meanwhile, the Short XRP ETF provides inverse exposure, allowing investors to profit from declines in XRP’s price. For those seeking even greater exposure to downward trends, the Ultra Short XRP ETF doubles the potential gains or losses from falling prices.

These products will join Teucrium’s XRP futures ETF , which began trading on the New York Stock Exchange (NYSE) on April 8 and reported strong initial trading volumes. Together, these developments mark significant milestones for XRP as it seeks broader adoption among institutional investors.

ProShares is also pursuing approval for a spot XRP ETF , alongside seven other similar proposals. Most of these filings face a second decision deadline in late May, with some extending to mid-October. Notable among these is the Grayscale conversion requirement and the 21Shares proposal , both of which could further shape the future of XRP-based financial products.

Market Potential and Regulatory Hurdles

A January prediction by JPMorgan estimates that XRP exchange-traded products (ETPs) could attract between $4 billion and $8 billion in net inflows , drawing parallels with the success of Bitcoin (BTC) and Ethereum (ETH) ETFs. This projection reflects growing institutional interest in regulated crypto-related financial instruments. However, the postponement of ProShares’ XRP futures ETFs underscores the challenges of bringing altcoin-based products to market. Regulatory hurdles and logistical delays continue to pose obstacles, even as momentum builds for broader adoption of crypto ETFs.

What the Future Holds for XRP Futures ETFs

Despite the delay, the eventual launch of ProShares’ XRP futures ETFs remains likely. Once trading begins, these products could significantly enhance XRP’s market position by attracting institutional capital and increasing liquidity. In the meantime, Ripple is focusing on expanding its real-world use cases, particularly in cross-border payments and blockchain-based solutions, to strengthen its value proposition beyond speculative trading.

Investors should closely monitor upcoming SEC decisions on spot XRP ETF applications, as well as broader regulatory developments. These factors will play a crucial role in shaping the future of XRP-based financial products and determining their long-term viability.

Final Thoughts

The postponement of ProShares’ XRP futures ETFs highlights the delicate balance between innovation and regulation in the crypto space. While the delay may disappoint investors, it also emphasizes the importance of ensuring robust frameworks to protect stakeholders.

As the industry matures, products like XRP futures ETFs could serve as a bridge between traditional finance and digital assets. Whether or not these ETFs launch soon, Ripple’s ongoing efforts to innovate and expand its ecosystem remain critical to its long-term success.