The crypto markets crumble a massive punch. Bitcoin dropped from its crown of $109,071 to roughly $75,000—a 31% fall. Ethereum crashed from $3,453 to around $1,400, off 59%. Altcoins like SOL shed 67%, and TRUMP tanked 89%. These aren’t soft landings; they’re market wrecks testing every investor’s spine, new or seasoned. Whether you’ve seen cycles or just stepped in, these jolts likely threw you off. Is this the endgame, or a boot camp for your rise? Let’s sift through the wreckage.

We’re All Taking Hits

As prices melt, panic and powerlessness rush in. Even grizzled traders like me rack up losses in these blasts. It’s not just figures—it’s a slam to your faith and feelings.

From the buzz of market highs to the chill of drops, everyone catches a bruise. It’s beyond bucks; it’s a mental slog. No matter how slick your portfolio spread, this mess rattles your head.

Stop and Tend to Yourself First

When markets thrash, instinct yells to jump in and snatch back what’s gone. That’s where folks often fumble into disasters.

Instead of charging, chill out. Your mind and frame matter more than any deal now. Ditch those flashing graphs, skip the online gloom, and grab some calm. A full plate, deep sleep, or a mellow roam can steady you. A clear head drives sharp calls—that’s your rock.

“Log Off, Reset” Your Mindset

The tiniest tweaks can lift you. Dodge the flood of dire news and sink into life’s roots to shake off strain. Cut the cord for a day—drop the tech entirely. Breathe big, sync with yourself. That stillness refuels your drive. Before sweating your balance, patch yourself up first.

Size Up Losses with Cold Logic

When your pulse evens out, snag a sheet and track your investment ride. Don’t wallow—hunt why losses snowballed. Did you lean too hard on leverage? Skip a stop-loss? Chase buzz or shaky scoops? Log every gem. The bite stings, but the know-how you nab fuels your next moves.

Restitch Your Life One Thread at a Time

Don’t lunge for the next big score. Begin by weaving your days back together. Rest right, fuel well, keep active—these patterns steel your mind and bones. As balance seeps in, jitters fade. This isn’t just market warmup; it’s a whole self-reboot.

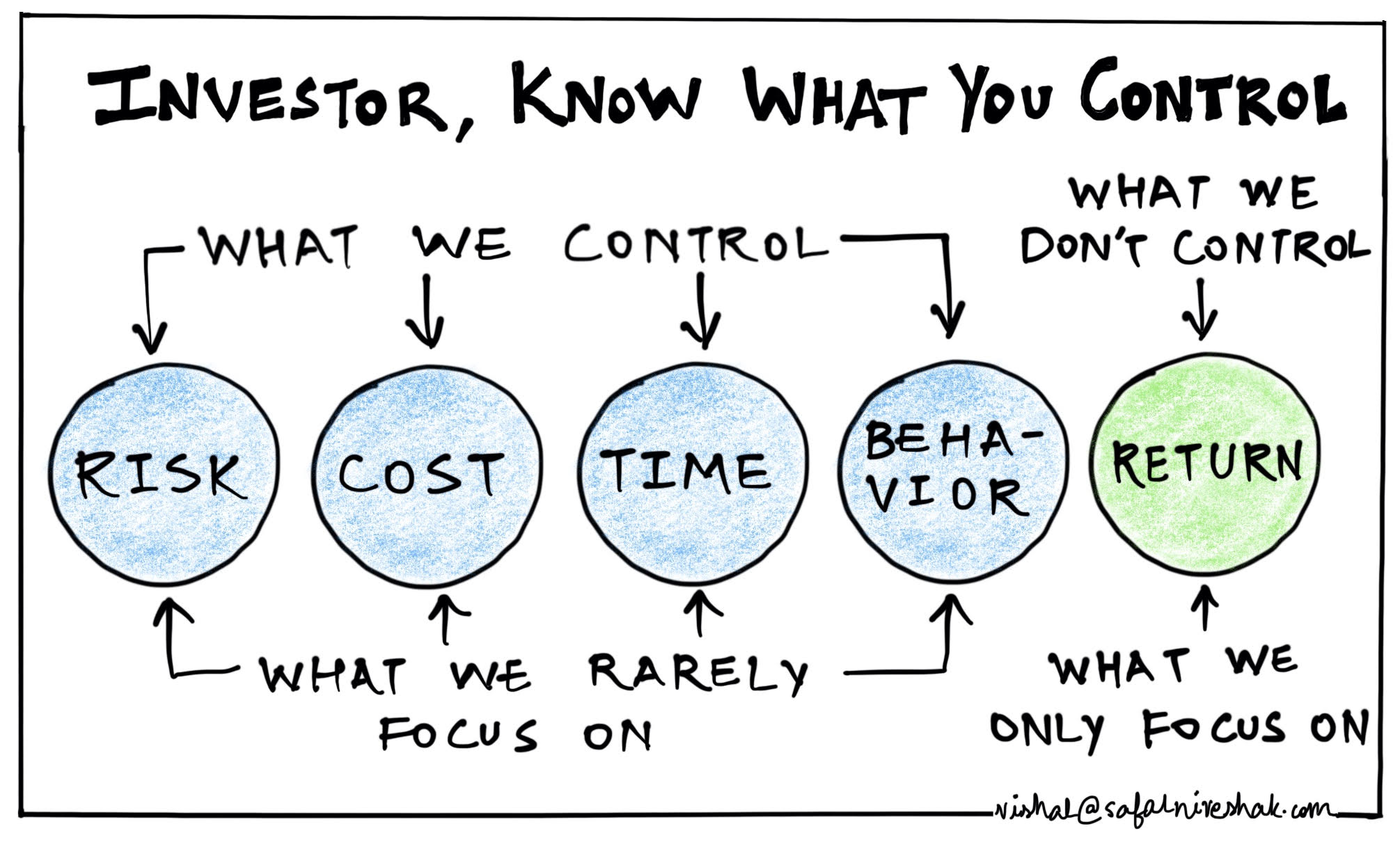

Grip What You Can Rule

Markets run rogue, but your wits and will stay yours to forge. Revisit your trade trail, weigh wins and wipes. Plug into Nansen or DeBank for market meat, or tail whale wallets to steal their playbook. The more you soak up and stay awake, the less feelings trip you. That’s your shot at steady glory.

Don’t Dash to Dig Out

After a smack, the yen to reclaim it all blazes. That spark often births bold flops—huge risks or nonstop spins—that gut accounts. Dig in your heels instead. Wait for the frenzy to cool and hints to firm before you swing. Clever traders bank on timing and hit when it’s ripe, not in the roar.

Hurt Grows You, Alertness Arms You

This raw crash dangles a prize: it spotlights your slips. You glean care and guts from it. Your gait might ease, but each move toughens. Hard knocks don’t just age you—they bare your strength.

Sticking It Out Tops the Dropouts

If you’re still tuned in, you haven’t bowed out despite the dings. Next to the 90% who’ve split, you’ve got stamina and spark. Losses don’t pin you—your climb does. These gauntlets shape you into a leaner, keener trader.

Cool Down, Heal Up—The Future Beckons

Markets sway and swing, and you’ll rise through each turn. A calm noggin and crisp view crack open lasting hauls. As you tweak yourself, new plays will peek out. When they drop, you’ll be geared to scale up and nab a glowing tomorrow.

Conclusion: Shape Setbacks Into Springboards

A market crash isn’t curtains—it’s a nudge to pivot and prosper. By pacing yourself, nursing your roots, and upping your craft, you twist turmoil into traction. The blast rumbles now, but your pluck and progress will carve your course. Stay the course, keep wise, and watch this leg fuel your winning streak.