As anticipation builds ahead of the official token launch of ZORA on April 23, the crypto market is increasingly focused on one key question: Can ZORA reach to $0.1 in the days or weeks following its TGE (Token Generation Event)? With a unique positioning in the Layer 2 space and strong pre-market activity, ZORA is shaping up as one of the most-watched early-stage tokens of Q2 2025.

This article explores market data, tokenomics, investor sentiment, and external factors to evaluate the probability of ZORA hitting the $0.1 milestone.

Pre-Market Trading: ZORA Gains Early Momentum

ZORA token is already being traded on pre-launch platforms like Gate.io, Whales Market, and MEXC, providing a glimpse into early investor behavior and market appetite.

Gate.io Pre-Market:

- Current price: $0.0202, reflecting a 55% drop from its daily high of $0.0587.

- Volume traded: Approximately $92.63K over the last 24 hours.

- Most active trading zone: $0.02 – $0.033, suggesting accumulating demand in this range.

Whales Market:

- Active trading price: Around $0.0339, +17.2%.

- Highest ask price: $0.055, while highest bid reaches $0.1, indicating wide spread and thin liquidity.

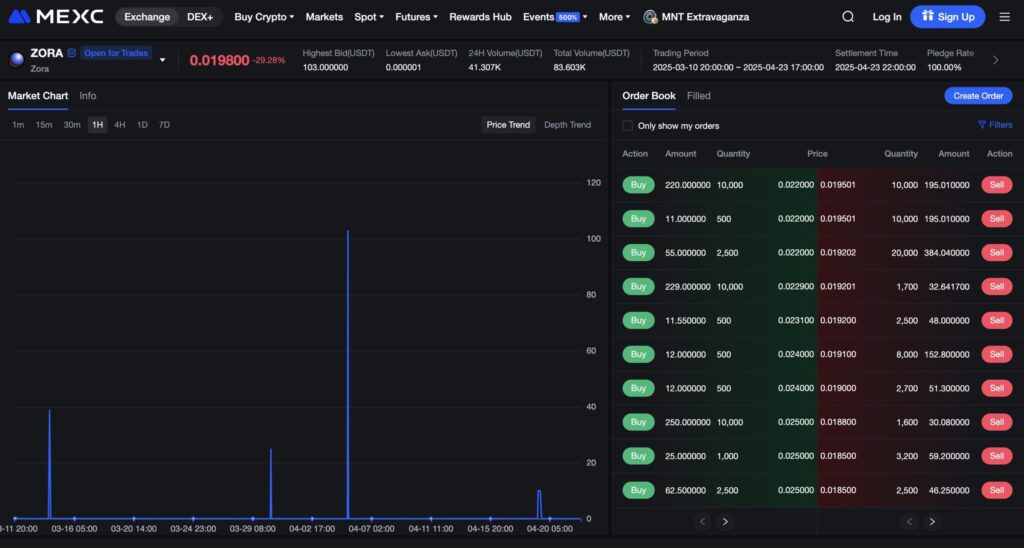

MEXC Pre-Listing:

- Listed around $0.0198.

- Some large orders filled at higher speculative levels between $0.27 – $0.33, possibly from FOMO-driven buyers.

The variation in price across platforms indicates fragmented liquidity and speculative trading behavior typical of pre-launch tokens.

Key Market Metrics and Token Valuation

ZORA has a total supply of 10 billion tokens, with approximately 3.5 billion tokens expected to be in circulation at launch. Based on its pre-market trading range of $0.03, the fully diluted valuation (FDV) stands around $300 million.

This puts ZORA in a relatively modest valuation bracket when compared to other Layer 2 tokens:

- Arbitrum: FDV over $1 billion.

- StarkNet: FDV above $1.5 billion.

- zkSync (projected): FDV expected to exceed $2 billion.

By comparison, ZORA is underpriced in terms of FDV, suggesting more upside if it gains traction post-launch.

Technical and Fundamental Short-Term Price Forecast

Short-Term (Before and Shortly After TGE):

- If current buying momentum continues and the market sentiment remains risk-on, ZORA could climb to $0.06 – $0.08 leading into or immediately following the TGE.

- In the presence of strong airdrop claims and positive news flow, a breakout toward $0.1 is plausible.

However, pre-market investors may also sell after claiming their tokens, introducing downward pressure shortly after launch.

Medium to Long-Term Outlook:

ZORA’s potential to reach $0.1 will depend on a few key post-launch dynamics:

- Sustained liquidity across major exchanges.

- Airdrop holders choosing to stake or hold, rather than sell.

- Real user adoption of ZORA’s on-chain applications.

If these factors align, a $0.1 price tag, corresponding to a $1 billion FDV, is achievable within 3–6 months.

What Makes ZORA Unique in the Layer 2 Ecosystem?

ZORA is not just another Layer 2 protocol. It is integrating blockchain infrastructure with a social content model, where users may earn tokens for posting content via the “token-per-post” mechanism. This hybrid of content creation and smart contract scalability differentiates it from purely DeFi-oriented L2s like Arbitrum or Optimism.

Additional strengths include:

- Deployment on Base (Coinbase’s L2 chain) for better user accessibility and lower gas costs.

- Airdrop of 1 billion tokens (10% of total supply) aimed at rewarding early adopters and boosting network effects.

- Backed by $60 million in VC funding, indicating strong institutional confidence.

ZORA’s ability to deliver consistent utility and user growth post-launch will be key to its long-term valuation.

Price Resistance and Support Zones

According to current trading data:

- Key resistance: $0.05. If ZORA breaks above this with significant volume, it could target $0.06–$0.07 before TGE.

- Support range: $0.035–$0.04. A drop below this could lead to bearish sentiment, especially if post-airdrop selling overwhelms buying interest.

These levels will be important to monitor as ZORA transitions from speculation to actual exchange listings.

Analyst Opinion: Can ZORA Reach to $0.1?

From a valuation and sentiment perspective, yes – ZORA can reach to $0.1 in the post-TGE period, but it will require:

- Bullish momentum from airdrop activity.

- Support from major CEX listings (Coinbase, OKX, or KuCoin).

- Continued community growth and developer traction.

Compared to other hyped tokens like Notcoin (NOT) or Portal (PORTAL), ZORA starts at a lower valuation and offers broader utility. This could make it a more sustainable mid-cap play with asymmetric upside potential.

However, risk remains—especially around token unlock schedules, liquidity fragmentation, and profit-taking by early investors. Investors are advised to closely watch on-chain activity and monitor sentiment shifts during the first 48 hours post-launch.

Conclusion

ZORA has all the ingredients for a breakout Layer 2 token—solid backers, real product use case, early liquidity, and an engaged community. While the pre-market currently values ZORA modestly at $0.025–$0.033, the potential to reach $0.1 is tangible if favorable market and network conditions align.

Investors should remain cautious of initial volatility but may find strong reward potential in ZORA’s fundamentals. In the context of a Layer 2 narrative gaining momentum in 2025, ZORA is one of the tokens to watch closely in Q2.